hayward ca sales tax rate 2019

The hayward california sales tax rate of 1075 applies to the following seven zip codes. The Hayward California sales tax is 975 consisting of 600 California state sales tax and 375 Hayward local sales taxesThe local.

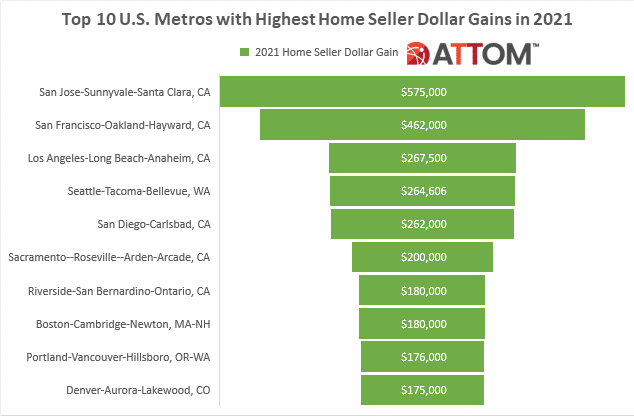

Top 10 U S Metros With Highest Home Seller Profits In 2021 Attom

City of Union City 1075.

. City sales and use tax rate changes Alameda Alameda County. Franchise Fees - 64. Ad with secure payments and simple shipping you can convert more users earn more.

Property Tax - 33. The state sales tax rate in California is 7250. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

You can print a 1075 sales tax table. 4 rows Hayward. Users Utility Tax - 105.

1788 rows California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. CA Sales Tax Rate. The current total local sales tax rate in Hayward CA is.

The 1075 sales tax rate in Hayward consists of 6 California state sales tax 025 Alameda County sales tax 05 Hayward tax and 4 Special tax. Sales Tax - 205. City of Hayward 1075.

Hayward in California has a tax rate of 975 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Hayward totaling 225. City of Newark 1075. Many local sales and use tax rate changes take effect on April 1 2019 in California as befits its size.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Hayward California is. Other TaxFranchises - 206.

The local sales tax rate in Hayward Puerto Rico is 1075 as of October 2022. The sales tax jurisdiction name. The statewide tax rate is 725.

The California sales tax rate is currently. Next to city indicates incorporated city City Rate. Those district tax rates range from 010 to 100.

City of San Leandro 1075. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 1 P a g e Note.

For a list of your current and historical rates go to the. The Hayward California sales tax is 975 consisting of 600 California state sales tax and 375 Hayward local sales taxesThe local sales tax consists of a 025 county sales tax a. The 9375 sales tax rate in San Jose consists of 6 California state sales tax 025 Santa Clara County sales tax 025 San Jose tax and 2875 Special tax.

Sales Taxes In The United States Taxable Itemsและcollection Payment And Tax Returns

Bay Area Cities Where Homeowners Saved Up To 30k On Property Taxes In Real Estate Boom

Used 2019 Lexus Nx Nx 300h For Sale In Hayward Ca Jtjbjrbz0k2109391

Summer Internship Report Shekhar Chandra Ca

How To Calculate California Unincorporated Area Sales Tax

Certified Pre Owned Nissan Offers For Sale Near Fremont Ca

California Sales Tax Rates By City County 2022

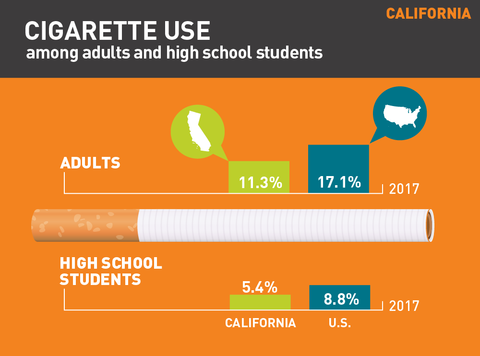

2019 California Tobacco Use Fact Sheet

675 Newbury Ln 241 Hayward Ca 94544 Redfin

Sales Tax In California Ballotpedia

How Much Is California Dispensary Sales Tax Breakdown

Minimum Wage In The United States Wikipedia

Most Expensive U S Cities Metros 2019 Tax Foundation

Used 2019 Gmc Sierra 1500 For Sale In Hayward Ca Edmunds

Retail Trade Challenges And Opportunities In 2019

Understanding California S Sales Tax

Hayward California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders